Singapore’s market-friendly tax regime is famed worldwide and has seen the country attract a host of celebrity immigrants like Jackie Chan and Jet Li.

As a favourable tax haven, Singapore’s taxation framework was curated to appeal to businesses and foreign professionals alike. This, in turn, has helped make the state one of the highest-ranked economies for investment, trade and employment.

Principally, Singapore’s system constitutes low corporate and individual income tax rates, as well as a range of tax incentives and tax relief measures.

Not to mention, the absence of capital gains tax, a territorial one-tier tax system and an extensive tax treaty network. By optimising its tax strategy with the perks highlighted above, Singapore is well aligned to growth-oriented economic goals.

As such, it has risen as one of the most favoured locations for global business visionaries, entrepreneurs and enterprises. However, before we consume all this detail, let’s take a step back to the basics.

What is Personal Income Tax?

In the simplest sense, personal income tax is a tax levied on individuals or persons depending on their income bracket, level of earnings or gains accumulated during a financial year.

Essentially, these earnings can be both actual and notional (with notional taxes, the responsible tax body estimates one’s income, tax debt, interest or penalties they should pay).

For the most part, Singapore employs a progressive taxation structure for personal income tax. Personal income tax in Singapore is exclusively administered by the Inland Revenue Authority of Singapore (IRAS). As mentioned before, Singapore’s personal income tax structure is one of the most favourable. Let’s delve into a few facts to highlight the Singaporean tax environment.

Key Summarized Facts about the Singaporean Taxation Framework.

- For individual income, tax is calculated from January 1st to December 31st, while corporate tax depends on the financial year adopted by the firm.

- Singaporean Tax rules and rates differ depending on one’s tax residency status.

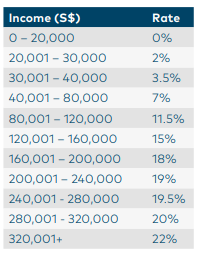

- For Singapore residents, the IRAS tax rate begins at 0% and ascends to a limit of 22% for income above S$320,000 per annum. For non-residents, personal income tax is charged at a rate between 15% to 22% or at the resident tax rates (whichever brings about a higher tax sum).

- Singapore imposes no capital gains tax, and the same applies to Wealth tax, estate or capital duty.

- Singapore does not also enforce tax on dividend income.

What income is taxable in Singapore?

Generally, persons are also only taxed on income earned in Singapore. That being said, the income earned while working abroad is not subject to taxation, notwithstanding a couple of exceptional cases.

Examples of taxable personal income include income earned from employment, property rental, non-corporate business earnings, royalties, investment income that doesn’t qualify as capital gains, and so forth. It is also worth noting that employment benefits such as bonuses, allowances, stipends, perquisites and benefits in-kind are also taxable.

Tax Residence

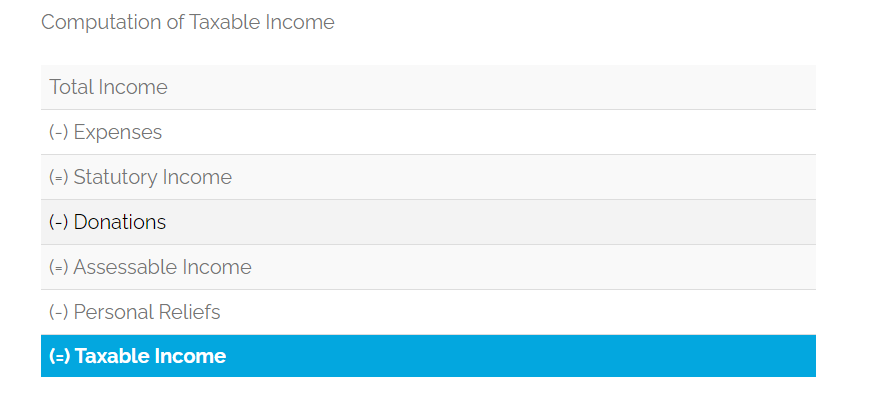

To accurately determine one’s individual income tax liability in Singapore, a person will need to first carefully ascertain their tax residency and determine their chargeable income, then subsequently apply the progressive resident tax rate to it.

Essentially, Singapore citizens, permanent residents (those who have established their permanent home in Singapore), inhabitants and outsiders who have remained or worked in Singapore for 183 days or more in the assessment year are viewed as residents.

As we shall see later, non-residents are primarily individuals who have remained or worked in Singapore for under 183 days in the respective tax year.

Consequently, as a tax resident, you shall be liable to:

- Taxation on income gained in Singapore

- Taxation on income after the institution of tax relief deductions at progressive resident rates.

- Taxation of foreign-sourced income brought into Singapore before January 2004. However, you shall be exempted from tax regarding foreign-sourced income on or after the first of January 2004 as long as it was not received through Singaporean partnerships.

Taxation of Overseas Income

Income amassed while outside Singapore is not taxable. This measure also applies to overseas income paid into a Singapore bank account. Be that as it may, such income is taxable if:

- Obtained through a partnership in Singapore

- The abroad employment is incidental to one’s Singapore employment

- The individual is hired by the Singapore Government to work abroad.

Generally, one doesn’t have to declare money earned abroad pay that is not taxable. However, one is still required to declare their qualified taxable overseas income under ‘employment income’ and ‘other income’ sections of their tax form (whichever appropriate).

Taxation of Non-residents

This section is worth focusing on for non-resident tax rate.. All things considered, non-residents employed in Singapore for 183 days or less in a tax year are excluded from taxation, with the exception of company directors, public performers and certain domain experts. However, non-resident taxpayers do not qualify to claim personal relief.

As a non-resident, the following tax criteria highlighted below shall apply to you:

- Your employment income shall be absolved of tax on the off chance that you are here on short-term/transient work for 60 days or less in a year. This exemption doesn’t have any significant bearing if you are the head of an organisation, a public performer or an expert professional in Singapore. Expert professionals are not limited to specialists, foreign speakers, sovereign counsels, expert advisors, mentors, coaches and so on.

- Suppose you are residing in Singapore for 61-182 days in a year. In that case, you shall be liable to taxation on all income earned in Singapore (at 15% or the progressive resident tax rate, whichever gives rise to a higher assessment amount). However, you can claim expenses and donations to save on your tax burden (though you won’t be eligible to claim personal reliefs). Furthermore, an individual’s employment income is principally taxed at 15% or the applicable progressive resident rate, whichever produces a higher tax amount.

- You are only burdened with paying tax on income earned in Singapore. However, Director compensations, consultation fees, specialist expenses incur tax at a prevailing rate of 15% to 22%.

- Non-residents are necessitated to file for income tax returns by filling form M, and failing or neglecting to do so can attract late penalties from IRAS. Entrepreneurs who manage Singaporean businesses remotely or regularly travel in and out of the country also belong to this group. Typically, a convenient alternative is to outsource the handling of your tax obligations to a professional tax preparation services provider.

- Lastly, non-residents are excluded from tax on the interest accrued from approved Singapore banks or monetary establishments.

Personal Income Tax for Employees vs Self-employed

As we hinted, personal income tax obligations in Singapore differ for employed and self-employed individuals according to the IRAS tax rate. As such, it is imperative to know where you lie. For context, let’s describe the two:

- Employees: In Singapore, a person who is serving an agreement/contract of service is viewed as an employee. This implies that the individual is qualified to get a standard compensation (salary) and incentives, under the employer’s rules. Employed individuals fill Form B1.

- Self-employed individuals: An independently employed individual in Singapore is a person who offers services to other individuals, works for himself, and incurs profit/loss directly. Under this class, there are freelancers, baby sitters, direct salespeople, brokers, agents, traders, and so forth. Principally, an independently employed person can either be the sole proprietor of a business or have a partnership in business.

In the simplest sense, individuals who have received full-time or part-time revenue/income from trade, business, vocation or profession are considered self-employed.

Self-employed individuals fill Form B when filing with IRAS. Such individuals should endeavour to keep comprehensive records and accounts of their business transactions such as invoices, receipts, vouchers, etc.

For more information on the differences, benefits, and deductions that affect employees’ tax obligations versus self-employed individuals, read here.

Tax deductions that affect personal income tax

Generally speaking, there are quite a number of tax deductions that individuals can qualify for in Singapore. For example, qualified employment-related expenses, rental-related costs, donations to approved charitable bodies, and individual reliefs are tax-deductible for Singapore residents.

However, one tax alleviation that everybody fits the bill for is the ‘Earned Income Relief’. For individuals under 55 years, the Earned Income Relief is $1,000; for those 55 to 59 years, the Earned Income Relief is $6,000. While those 60 or more, the Earned Income Relief is $8,000.

To paint a clearer picture of this, in the event that you are under 55 and earned $81,000 during the year, you’re guaranteed an Earned Income Relief of $1,000, among other pertinent reliefs. Aside from simply reducing the amount you need to pay as income tax, this can significantly reduce your annual tax assessment from 11.5% to 7%. Consequently, this can prove significant depending on the precise personal income tax bracket you fall in and how many deductions you are allowed to claim.

When computing your payable personal income tax in Singapore, you can claim the following available deductions:

- Expenses incurred by an individual over the course of employment. Generally, these deductions are not admissible in the case of personal income, or any revenue of capital nature. Applicable expenses must have been incurred in the course of carrying out or completing the official business duties or obligations. Here are a few examples of the aforementioned admissible expenses that qualify for tax breaks to workers:

- Entertainment expenses incurred in entertaining clients. Please note that you need to exclude your share of the entertainment (e.g. meal) expenses.

- Mosque building fund, zakat fitrah or any other religious dues authorised by law.

- Subscriptions paid to professional bodies or society for professional updates, knowledge and networking.

- Travelling expenses incurred on public transport, such as buses, trains, taxis.

- Donations made by the persons to qualified beneficent/charitable associations.

- Allowable expenses an individual incurs while obtaining rental income. This essentially addresses the net amount of rental income after the deduction of allowable costs like fixes and upkeep, local charges, fire protection and so forth, will be liable to taxation.

- Tax reliefs and rebates that the Singaporean government gives as acknowledgement of a person’s endeavours at personal development. These reliefs can include:

- Course Fee Relief – To urge people to overhaul their abilities.

- CPF Cash Top-up Relief – To urge people to save cash for retirement needs

- Supplementary Retirement Scheme (SRS) Relief – To urge people to put something aside for their mature age and so forth.

Personal income tax assessment procedure and compliance

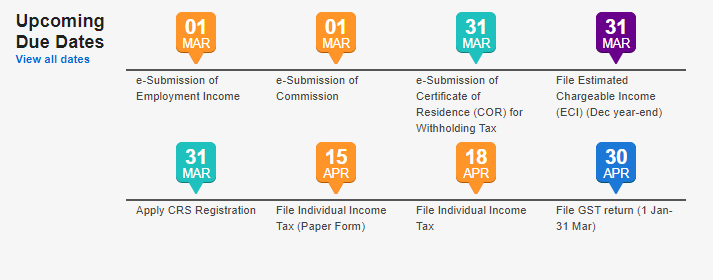

For the most part, personal income tax is evaluated and charged on a preceding year basis. As such, the tax year for individual income taxes is typically from January 1 to December 31. More specifically, the tax filing due date is typically April 15th of the year of assessment.

Once taxes have been filed, the Singapore government will proceed to issue to the person a tax bill called a Notice of Assessment (NOA) between May and September. Subsequently, on receiving the NOA, an individual is given 30 days to pay the assessed taxes.

In the event that the person disagrees with their assessment from the government body, then they can file an Objection of Assessment to correct or rectify the tax bill. That being said, the Objection of Assessment must also be filed within 30 days of receiving the tax bill. However, it is noteworthy that the individual is still obliged to pay the full amount specified by the NOA within 30 days, even in instances that they disagree with the tax bill. Consequently, if one’s taxes aren’t paid within the 30-day period, IRAS will proceed to issue them a penalty currently at 5%.

Tax filing requirements

As has been noted throughout this article, filing one’s tax return is a yearly duty for every eligible taxpayer. As highlighted prior, there are different tax forms that are issued to disparate categories of taxpayers such as residents, self-employed individuals and non-residents.

Reiterating, all taxation completed forms should be submitted to IRAS by the 15th of April every year. Furthermore, joint filing of returns is not permitted as spouses must individually file separate personal income tax returns to IRAS.

Individual income tax brackets and rates

As mentioned, people inhabiting Singapore are taxed on a progressive resident tax rate. Generally speaking, filing an annual income tax return is strictly obligatory for persons whose annual income is S$20,000 or more.

On the other hand, tax residents don’t have to pay tax if their income is under S$22,000. Be that as it may, individuals are still required to file their returns or fill the assessment form as a requisite by the Singapore Tax Authority.

A vivid reality is that different personal income ranges are taxed at a different rate. For instance, a person earning $80,000 will probably fall into the 7% tax bracket.

That being said, such a person is only required to pay approximately $3,350 in their income tax, yet when you actually calculate 7% of $80,000, it rounds off to $5,600. Such a figure is achievable probably due to deductions that an individual applies or claims for.

Here is a detailed list depicting the different tax brackets in Singapore.

Types of personal income tax not imposed in Singapore

Estate Duty

As of 2008, estate duty was absolved in Singapore. This levy typically revolves around inheritance.

A person’s estate incorporates: any gift made within five years before the death of the individual, everything owned in the person’s own name, and any assets in a trust from which the person receives an individual benefit.

Dividend Income

Generally, dividends refer to profit gained, or retained earnings accrued from one’s shareholding in a company. As of 2008, dividends paid by Singaporean companies to their shareholders are exempt from tax. Overall, this has boosted Singapore as an attractive place for foreign investors as several foreign investors currently hold assets in Singapore to maximise this exemption.

Capital Gains Tax

This tax is levied on personal gains of individuals, for example, any profit made from the sale of a fixed asset, gains on capital transactions, or interest earned on stocks. Singapore does not impose any capital gains tax.

Tax on Foreign Income

Overseas income is not taxable in Singapore as the country believes that income is already taxed in the respective country the individual lived before coming back to Singapore.

Tax Clearance

By definition, tax clearance is the process of settling all one’s tax obligations before the expiry of their work contract, or before switching to another employer. Tax clearance is also required in instances where one plans to leave Singapore for more than three months. In essence, non-residents must seek tax clearance on leaving Singapore and/or on leaving employment in Singapore, unless they are a Singapore Permanent Resident merely changing jobs.

How to avoid double taxation?

To avoid scenarios where a person’s income is taxed both in Singapore and in a foreign country, Singapore has an extensive set of double tax agreements (DTAs). Generally, a DTA is an agreement or treaty signed by two countries to address or avoid double taxation. On the other hand, to avert taxation on the same income twice, a person can also apply for double taxation relief.

Ways to Reduce Your Personal Income Tax Obligations in Singapore

It’s worth remembering that the maximum attainable income tax relief is S$80,000. So, a few actionable tips to claim deductions or to get more relief are:

- Making donations, whether monetary, shares, land, buildings artifacts or artworks. These attract up to 250% tax deduction.

- Saving for retirement is another way of reducing your tax obligations. For context, for each $1 that you put into your Supplementary Retirement Scheme (SRS) account 2021, you get $1 deducted from your existing chargeable income.

- Qualifying for automatic tax reliefs for parents, for example, working mothers get the most tax deductions.

- Making voluntary contributions to one’s Medisave account

- Claiming expenses brought about over the span of earning one’s income. Relatedly, landlords can also claim expenses incurred when maintaining rental properties (we discussed both earlier).

- Claiming child-related tax relief or “Parent Relief” that relates to in-laws, grandparents, and grandparents-in-law

- Claiming Course Relief for upskilling of up to $5,500. This can be for money spent on eligible courses or exam fees.

Final Remarks.

All things considered, taxes assist with subsidising and funding government spending on common assets like roads and security like the Singapore Armed Forces and Police Force.

So, it is imperative always to pay one’s taxes to reap such benefits. As we have also seen, Singapore offers several tax incentives and deductions while boasting a moderately low corporate tax rate and a favourable personal income tax bracket that does not impose taxes on capital gains.

The nation offers a few tax cuts, flaunts a moderately low corporate expense rate and top individual assessment section, and it doesn’t demand charges on capital increases.

With the institution of a highly favourable progressive personal income tax system that starts at 0% and peaks at 22% for employment incomes above $320,000, one can indeed commit to their tax obligations.

Disclaimer: The information contained in this blog is for general information purposes only and is not intended as legal advice. While we endeavour to provide information that is as up-to-date as possible, Intime Accounting makes no warranties or representations of any kind, express or implied about the completeness, accuracy, reliability, suitability or availability with respect to the content on the blog for any purpose. Readers are encouraged to obtain formal, independent advice before making any decisions.