External stakeholders barely have access to insider information of the entity they plan to invest in or are invested in. Even most stakeholders within the company have an incomplete picture of the organization’s performance.

It is why stakeholders resort to the financial statements of an entity to understand its performance and compare the same with its past results. These include the cash flow statement, balance sheet, and profit and loss statement (P&L).

The profit and loss statement is the one to go to if you want to understand the organization’s profitability and performance across verticals. This article discusses everything you need to know about the profit and loss statement.

Profit and loss statements

The profit and loss statement is a periodic financial statement, prepared typically for every quarter, half-year, and financial year. It presents the company’s revenues and expenses (either on a cash or accrual basis) relevant to the period. As the name suggests, it helps in understanding if the business’s endeavors resulted in it being profitable or was it in losses.

Cash vs. accrual basis

Every company has to choose if they want to follow the cash or accrual accounting basis at the beginning of the financial year. They aren’t allowed to switch in the middle of the year.

Cash basis refers to the company recognizing revenues and expenses whenever the transactions involve cash (inflow or outflow).

For example, if the company is buying stationery on credit worth SGD 50 on 21/03/2021 and makes the payment on 01/04/2021. The date of transaction recording would be 01/04/2021 and not 21/03/2021.

Similarly, the revenue basis of recognition follows entry on the transaction date (irrespective of whether cash is paid or received).

For example, if the company is buying stationery on credit worth SGD 50 on 21/03/2021 and makes the payment on 01/04/2021. The date of transaction recording, in this case, would be 21/03/2021 and not 01/04/2021.

Are all companies required to prepare a profit and loss statement?

As per IRAS (Inland Revenue Authority of Singapore), Singapore companies must report their revenue and ECI (estimated chargeable income) via the ECI form within three months from the end of the financial year.

In addition, companies must file their approved financial statements (annual return) with ACRA within a month of their AGM (annual general meeting) for the financial year.

It includes their financial statements, details about their company officers, registered address, and more. So, every company operating in Singapore is liable to prepare and file its profit and loss statement with ACRA within the requisite due date.

What is the purpose of preparing a profit and loss statement?

In simple terms, a profit and loss statement summarizes the revenues, costs, and expenses incurred during a period to showcase the net performance of the entity. It also helps compare past performance to understand the growth trajectory by pitting the current P&L against the recent past ones, say YoY (year-on-year) or QoQ (quarter-on-quarter) basis.

Single-step vs. multi-step profit and loss statement

Businesses can either prepare single-step or multi-step profit and loss statements as part of their financial documents. A single-step statement is a direct way of reaching the net profit of the organization for the period.

In comparison, a multi-step P&L bifurcates operational and non-operational incomes and expenses to present a more detailed view to the management. It includes calculation of gross profit followed by calculation of net profit.

So technically,

Under single-step P&L

Net Profit = (Revenues + Gains) – (Expenses + Losses)

Under multi-step P&L

Gross Profit = Revenue from sales – Cost of Sales

Net Profit = Gross Profit + Non-operating Incomes – Non-operating Expenses and Losses

Read our article on how to calculate accounting profit and loss for more detailed insights.

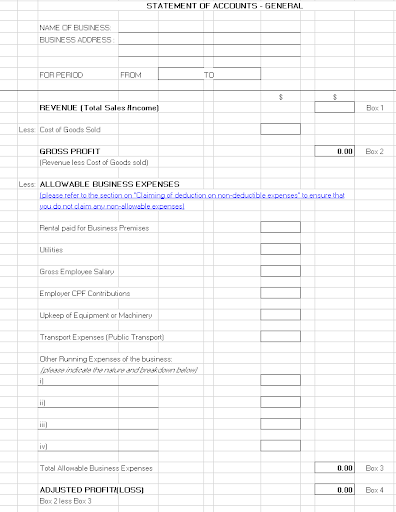

Now have a look at the sample P&L to ensure you place items correctly.

Sample P&L

How to analyze a profit and loss statement?

Like a balance sheet, the profit and loss statement houses a plethora of components that stakeholders and other interested parties look into. While the numbers can be overwhelming for some, these are essential to present a meaningful view of the business and its operations.

Here are the primary components of a profit and loss statement of an entity in Singapore –

1. Sales

As explained above, a P&L summarizes all the revenues and expenses incurred in a period. So the first obvious thing to look into is revenues, and a significant portion of it would be sales. If the statement is a consolidated one, it will present sales across divisions and product categories.

The sales figure and the description help you understand the sources of income for the company regarding product/service categories and divisions. It also enables you to compare the numbers against the past figures to understand the organization’s performance in the present period.

2. Cost of goods sold

If the company is selling something, it is imperative that there will be several direct costs attached to it. For example, there are costs of raw material, direct labor, and overheads required to get the final sellable output. If you are selling a service, direct commissions or salaries of consultants can form the cost of goods sold.

It is pertinent for you to understand how your business’s cost of goods sold is broken down into multiple components and the key cost drivers.

In addition, you can also compare the current figures with the past ones to understand if there is a significant change in costs related to any item or service and the reason behind it.

3. Gross Profit

If you add expenses required for selling the products/services to the cost of goods sold, it would be the cost of sales. Direct income minus the total cost of sales is the gross profit. It refers to the profits the core business has been able to generate before taking into contention indirect revenues and expenses.

The gross profit ratio is a crucial indicator for every business’s operational performance. The figure enables you to understand if you have been successful in optimizing your costs compared to the previous periods or if your core business is less profitable for some other reason.

Most companies also prefer breaking the gross profit ratio product-wise to optimize their endeavors and focus on the more profitable divisions/products.

4. Other expenses

There are several expenses other than direct expenses that form part of total expenses. While some of them are recurring, others can be a one-time affair. It includes expenses, such as depreciation, office rent, and more.

These figures showcase the expenses that are not a part of the operation but are critical for business operations. In addition, when you compare these figures with the past financial statements, these present an opportunity to optimize ancillary costs.

5. Other incomes

An organization often has multiple other streams of revenues that are equally vital for its success. For example, dividend income is one of the most common other income sources for an organization. In addition, rental income, royalty, and others often find themselves part of the company’s P&L statement.

So while analyzing a profit and loss statement, it is vital to understand if any of these ancillary income sources are taking a toll on the core business and its functioning. In addition, care should be taken to know if any of these negatively impact the brand and how people perceive it.

6. Profit margin

Profit margin or net profit is the profit that remains after deducting all business costs from all its revenues. A business exists to make profits for its shareholders, and profit margin is one of the most critical criteria while looking into a profit and loss statement.

Net profit represents the profits available to invest back in your business, repay debts, or pay as dividends to your shareholders. While net profit is different from cash earned, it is a critical criterion while ascertaining a business’s financial situation.

Wrap up

Profit and loss statement is an integral part of the financial statements of an enterprise. Most stakeholders carefully go through each of the items listed to ensure there are no warning signals and the company continues to have strong fundamentals.

A P&L is viewed in conjunction with a balance sheet to get deeper insights into the company’s performance. It enables the viewers to garner knowledge about how the company is being run and its probable trajectory.

Contact us at Intime Accounting if you need more help working on your accounts and managing profit and loss statements.

Disclaimer: The information contained in this blog is for general information purposes only and is not intended as legal advice. While we endeavour to provide information that is as up-to-date as possible, Intime Accounting makes no warranties or representations of any kind, express or implied about the completeness, accuracy, reliability, suitability or availability with respect to the content on the blog for any purpose. Readers are encouraged to obtain formal, independent advice before making any decisions.