Every company in Singapore maintains its financial statements in some way or the other. These refer to documents that help the onlookers to gauge the financial position of the company. While the outsiders only look into the figures, the insiders have to do a lot of work to ensure that the financial statements are presentable and in adherence to the requisite rules.

It brings us to today’s discussion – trial balance vs. balance sheet. While many people consider both the same, many others fail to differentiate between the two.

What is trial balance?

A trial balance is an internal document with the ending balance for every account that acts as the base for all financial statements. It is prepared to check the arithmetic accuracy of the transactions recorded in the accounting records. It is prepared as on a date and showcases the closing balances of all the general ledger accounts.

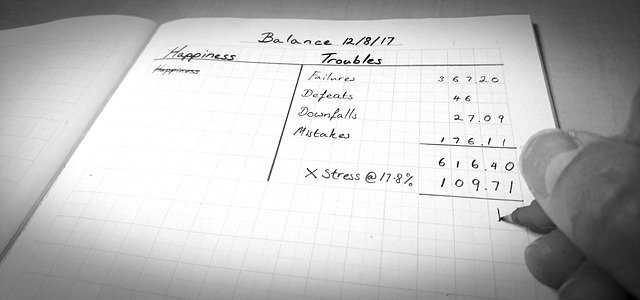

What is a balance sheet?

The balance sheet is a part of the financial statements prepared by the accountants. It is a statement summarising the company’s equity, assets, and liabilities on a particular day.

A balance sheet may be issued only for internal use, or it may also be intended for such outsiders as creditors and investors, also known as a “statement of financial position.”

Difference between trial balance and balance sheet

Here are the key differences between a trial balance and a balance sheet –

1. Meaning

Trial balance is a mere compilation of all the closing general ledger balances, whereas the balance sheet reports the financial position on assets, liabilities and equity. The latter is an extension of the accounts recorded in the trial balance.

2. Usage

A trial balance is an internal document and is not presented to the external stakeholders. In contrast, the balance sheet is a part of the financial statements prepared both for internal and external stakeholders.

3. The primary reason for drafting

The primary reason for drafting a trial balance is to check if the debit balance matches the credit side. Similarly, the primary motive behind preparing a balance sheet is to establish the accuracy of the financial position of the company’s accounting records.

4. Heads

A trial balance usually has two primary heads – debit and credit. In contrast, a balance sheet has three primary heads – equity, liabilities, and assets. We can further bifurcate the liabilities and assets into current and non-current sub-heads.

5. Preparation stage

A trial balance is prepared after the accountant has successfully closed all the general ledger accounts. At the same time, a balance sheet is prepared after preparing the trial balance.

6. Format

We prepare a trial balance for internal reference, and there are no prescribed formats that are to be followed while preparing it. In contrast, a balance sheet that forms part of the financial statements and is shown to external stakeholders. So there are specific accounting standards that the company must adhere to while preparing it.

Can we prepare a balance sheet from the trial balance?

If a company makes a trial balance, it acts as the basis for preparing the balance sheet. So, yes, you can draft a balance sheet from a trial balance.

Wrap up

The differences between a trial balance and a balance sheet are stark. While the former is optional, the latter is mandatory by law and forms a part of the company’s financial statements.

The article is a part of our comprehensive series on “Trial balance”.

Disclaimer: The information contained in this blog is for general information purposes only and is not intended as legal advice. While we endeavour to provide information that is as up-to-date as possible, Intime Accounting makes no warranties or representations of any kind, express or implied about the completeness, accuracy, reliability, suitability or availability with respect to the content on the blog for any purpose. Readers are encouraged to obtain formal, independent advice before making any decisions.